|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding Chapter 7 Bankruptcy in Arkansas: Key Facts and Practical Insights

Filing for Chapter 7 bankruptcy in Arkansas can be a complex process, but it offers a fresh start for those overwhelmed by debt. This article provides a comprehensive guide to help you navigate through the intricacies of Chapter 7 bankruptcy, including eligibility criteria, the filing process, and its potential impact on your financial future.

Eligibility Requirements for Chapter 7 Bankruptcy

Before filing for Chapter 7 bankruptcy in Arkansas, it's essential to understand the eligibility criteria. The primary requirement is passing the means test, which assesses your income and expenses.

The Means Test

- Compares your income to the state median income for a similar household size.

- Ensures that only those who truly need relief can file under Chapter 7.

For detailed guidance, consider consulting with a bankruptcy attorney columbia sc who can provide professional advice tailored to your situation.

The Filing Process

The filing process involves several steps, each crucial to the success of your bankruptcy case.

Gathering Documentation

- Compile a list of all your debts, assets, income, and expenses.

- Gather tax returns, pay stubs, and bank statements.

Submitting Your Petition

- File the bankruptcy petition with the Arkansas bankruptcy court.

- Pay the necessary filing fees or apply for a fee waiver.

Once your petition is filed, an automatic stay goes into effect, halting most collection activities against you.

Life After Chapter 7 Bankruptcy

Post-bankruptcy life can be a period of financial rebuilding and recovery.

Rebuilding Your Credit

- Consider secured credit cards to start rebuilding your credit score.

- Maintain consistent payments to demonstrate financial responsibility.

Exploring financial counseling can be beneficial. For expert advice, reach out to a bankruptcy attorney des moines who can offer guidance on credit recovery.

Frequently Asked Questions About Chapter 7 Bankruptcy in Arkansas

What debts can be discharged in Chapter 7 bankruptcy?

Most unsecured debts like credit card balances, medical bills, and personal loans can be discharged. However, student loans, child support, and certain tax debts are typically not dischargeable.

How long does the Chapter 7 bankruptcy process take?

The process typically takes about four to six months from filing to discharge, depending on the complexity of your case and the court's schedule.

Will I lose all my property in Chapter 7 bankruptcy?

Not necessarily. Arkansas law allows you to keep certain exempt property, such as your primary residence and necessary personal items, up to a specified value.

Can I file for Chapter 7 bankruptcy more than once?

Yes, but there must be at least eight years between your previous Chapter 7 discharge and the new filing.

Understanding the nuances of Chapter 7 bankruptcy can empower you to make informed decisions about your financial future. Always consider seeking professional advice to navigate this challenging process effectively.

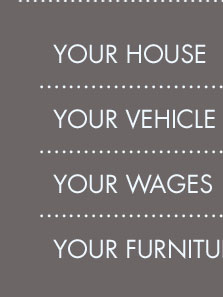

What You Can Keep in a Chapter 7 - Equity in your home - Equity in a vehicle - A burial plot - Personal property like clothing and jewelry, books, musical ...

A bankruptcy filed under Chapter 7 is designed to discharge the outstanding debts of so called "honest debtors" and allow them to start fresh free from the ...

Chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt.

![]()